The high effort/low reward mechanism to input expenses and lack of responsive money management (react positively, appropriately and quickly to user’s dynamic spending habits) are the reasons why people are not using the available mobile based personal finance applications to record their day to day expenditure.

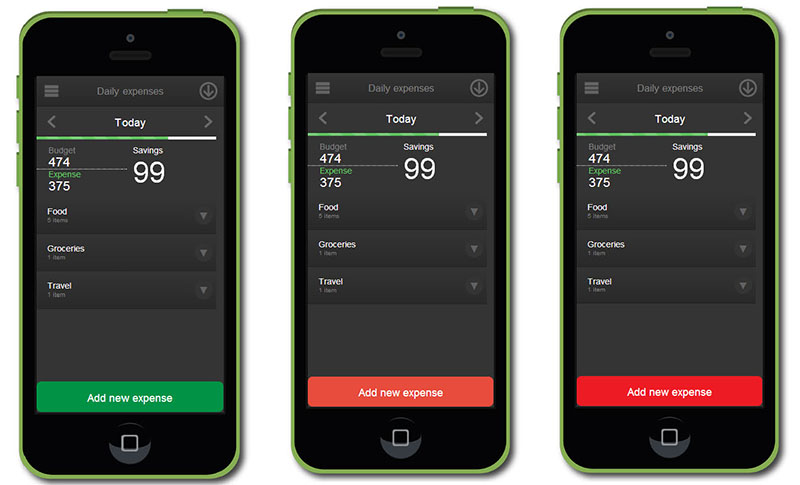

This project aims at helping user to spend his money based on his needs and follows a logic based budget (a reasonable way of thinking about managing user’s money for his day to day activities) rather than following up a budget made over fixed and non-responsive assumptions like how much money left - how many days to survive.

Here I am using visualization as a tool for the user to generate insights about his expenditure and help him accomplish his meaningful goals. I am also using prediction of user’s daily budget and expenses to support user (remind user about expenses that he possibly may/may not have) and minimize the input effort.

This project led to the development of a mobile phone based finance application that involved the study of existing mobile personal finance applications, online shopping websites, identifying the existing problems and trying to solve each of them by different approaches.

I explored different ways to input expenses, create a responsive budget and finally designed a prototype and tested it over a period of 30 days for accuracy of the prediction and usability of input mechanism.

Case Study Download:

• Personalized Data Visualization......