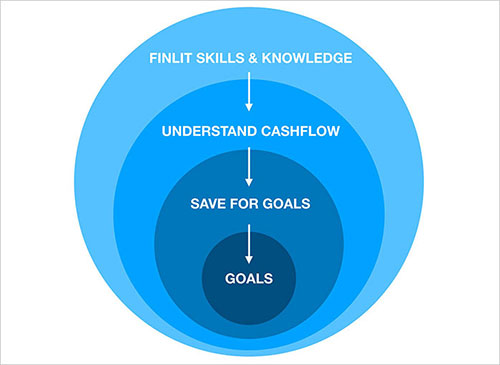

Financial Literacy refers to the set of skills and knowledge that allows an individual to make informed and effective financial decisions which influences general well-being and overall quality of life. The target users for this project are young migrant salaried individuals of Mumbai, belonging to the lower-income strata, who “earn enough to stay afloat but not enough to save”. These individuals are forced to start working at a very early age due to poor financial condition of their families. A chronic problem that they face during their working lives is the exhaustion of income without their knowledge of where all the money went, leaving them without any funds to save. Primary research has identified that - due to the lack of expense tracking habit, the concerned individuals are unable to get a global view of their incoming and outgoing cash flow, which prevents them from identifying the high expense streams and thus plannning necessary action to cut down expenses.

In addition, these young individuals have family responsibilities, personal ambitions and dreams like - starting a business, learning a new skill, marriage of sisters, repairing or constructing their homes, agricultural requirements etc. Due to non-existent savings, these responsibilities often lead to financial shocks (sudden requirement of funds) and that is when the individual or his family resorts to loans from mostly rural community funds, thus incurring debt and interest rates which further cuts down on their incomes, which delays or impedes achieving their personal dreams. In this project I propose a service that allows young migrant individuals to budget and track expenses digitally, while steadily saving for personal/family goals with other family members in a collaborative manner. The service leverages on existing financial literacy infrastructure i.e. NGOs, content creators, finance experts etc. to provide financial tips, information and workshops aligned with an individual's personal and family saving goals.

Case Study Download:

• Service Design for Financial Literacy......

• Service Design for Financial Literacy- Report......